student loan debt relief tax credit virginia

National Debt Relief Review. Thirteen states could decide to tax forgiven student loan debt on 2022 tax returns according to the.

Marylanders Have Less Than One Month To Apply For Student Loan Debt Relief Tax Credit Wjla

UPDATED Tuesday March 24th 2020.

. The American Rescue Plan Act of 2021 included tax-free status for all student loan forgiveness and debt cancellation through December 31 2025. Maryland taxpayers whove incurred at least 20000 in debt for undergraduate or graduate student loans and still owe at least 5000 in outstanding student debt are encouraged to complete the. How to Qualify for an Art Institute Student Loan Refund.

3 Best Credit Repair Companies You Can Trust in 2022. If you dont want to pursue a BDAR. Ascent offers both co-signed and non-co-signed student loans which gives borrowers without co-signers more college funding options.

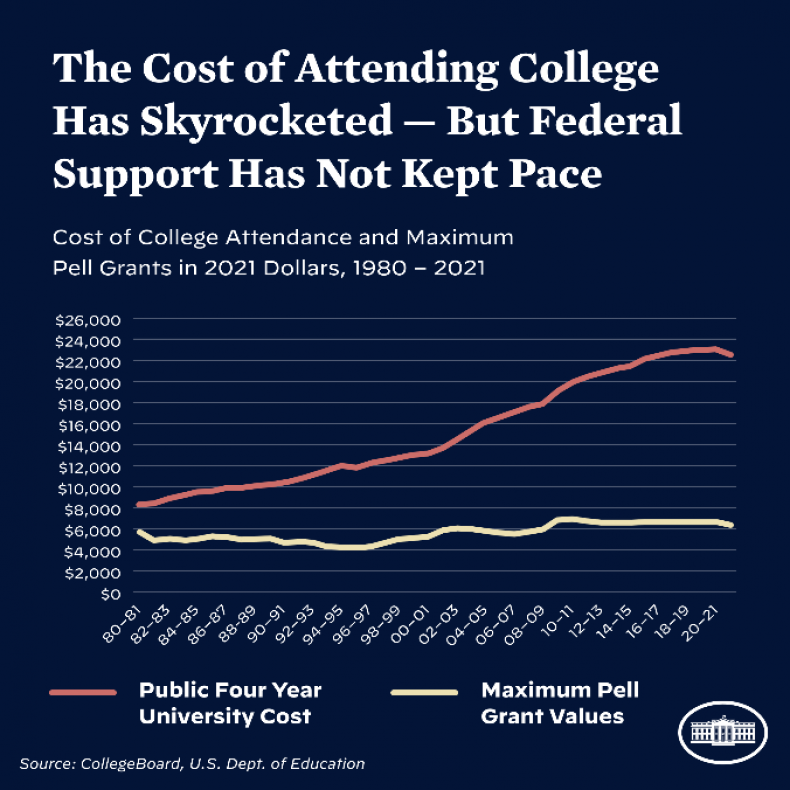

More than 40000 residents have received the tax credit since the start of the program in. This primarily affects the forgiveness after 20 or 25 years in an income-driven repayment plan. Speaking at the White House on Wednesday President Biden said that borrowers earning less than 125000 a year would have 10000 in student loan debt forgiven.

Biden said he would cancel up to 10000 in federal student loan debt for borrowers who earn less than 125000 per year or under 250000 for married couples who file jointly. If a school closed while you were enrolled or not long after you withdrew there are options available to eliminate your student loan debt. The states are considering taxing up to 10000 in forgiven student loan debt as income.

Evan Vucci - staff AP The average undergraduate federal student loan debt for WVU students is about 25000 and about a quarter of the schools undergraduates receive Pell Grants. If you have Federal Student Loans related to one of the Art Institute schools that has now closed down you may be able to qualify for having your loans forgiven perhaps even entirely. Paul Morigi Getty Images We the 45m By.

3 Top Rated Tax Relief Companies. If you attended ITT Tech between 2006 and 2016 then you may qualify for ITT Tech student loan forgiveness benefits via either the The Borrowers Defense To Repayment program or the Closed School Loan Discharge program. President Joe Biden speaks about student loan debt forgiveness in the Roosevelt Room of the White House Wednesday Aug.

Tax-free Student Loan Forgiveness. In Sept 2018 I had 99782 in credit card debt. Personal Business Debt Settlement Debt Negotiation Consolidation IRS State Tax Debt Relief.

Congress also took action concerning the tax treatment of student loan debt forgiveness. I contacted American Consumer Credit Counseling ACCC and entered into a consolidation program because they dont stop paying the debt to force a settlement. Instead they negotiated a lower interest rate with each of the creditors without hurting my credit rating.

For those who have Pell Grants 20000 in student loan debt will be canceled. 1 day agoMINNEAPOLIS AP President Joe Bidens student loan forgiveness plan could lift crushing debt burdens from millions of borrowers but the tax man may demand a cut of the relief in some. Marylands student loan debt relief tax credit has been providing relief to residents for years now.

IRS Fresh Start Program. Student loan borrowers in front of the White House celebrate the relief of debt cancellation while also calling on Biden to cancel what remains. Across the United States 45 million people owe 16 trillion for federal loans taken out for college more than they owe on car loans credit cards or any consumer debt other than mortgages.

UPDATED Tuesday March 24th 2020. FREE Consultation 1-877-850-3328 - CuraDebt. How to Qualify for the ITT Tech Lawsuit Student Loan Forgiveness Program.

We scored the company based on its co-signed credit-based. The government has programs to relieve crushing tax debtIf youve fallen far behind on income taxes owed to the government the IRS has set up the Fresh Start program a series of rules changes that make it much easier to pay back that debt to the governmentOne part of Fresh Start makes it easier to use a government debt consolidation. IRS Debt Forgiveness Guide.

24 2022 in Washington. The first group of class members approximately 200000 borrowers whose school is on the list will automatically get full settlement relief which includes full discharge of their loans refund of amounts paid and credit repair according to a press statement by Project for Predatory Student Lending.

Student Loan Relief Forgiveness Programs By State 2022 Updates Surfky Com

Student Loan Help For Millions Coming From Biden After Delay The Washington Post

/cloudfront-us-east-1.images.arcpublishing.com/gray/TWA6TGZHUZG4PBO6TOO6UL2B7A.jpeg)

Some States Could Tax Biden S Student Loan Debt Relief

Student Loan Forgiveness Who Qualifies And Income Limits Money

Biden Announces 10 000 In Student Loan Debt Relief The New York Times

Student Loan Forgiveness Updates Next Steps For Qualifying Borrowers

Comptroller Urges Marylanders To Apply For Student Loan Debt Relief Tax Credit By Sept 15 The Moco Show

Virginia Student Loan And Financial Aid Programs

Virginia Loan Repayment Programs Health Equity

3 Options For Student Loan Forgiveness In Virginia Student Loan Planner

Some States Could Tax Biden S Student Loan Debt Relief National Dailyindependent Com

Biden Issues Any Decree He Wants On Student Loan Forgiveness Foxx

Public Service Loan Forgiveness Do You Qualify For It Student Loan Hero

Who Owes The Most Student Loan Debt

How To Claim Student Loan Tax Credits And Deductions Student Loan Hero

Biden S Student Loan Forgiveness Could Be Taxable In Some States