child tax credit portal update new baby

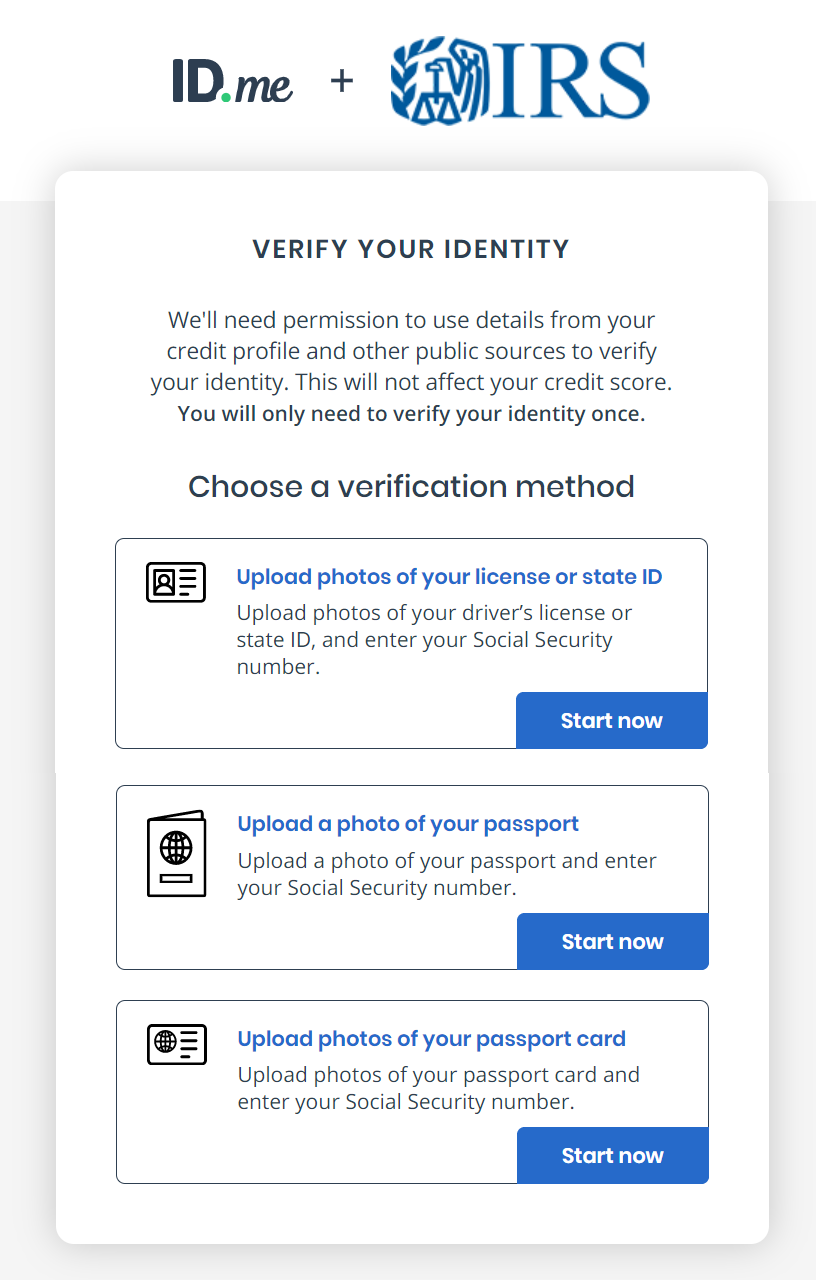

To apply applicants should visit. The Child Tax Credit Update Portal lets you opt out of receiving this years monthly child tax credit payments.

How To Claim The Child Tax Credit For A Baby Born In 2021 Goodrx

I had my first child in April 2021.

. Now instead of 2000 parents can claim 3600 for children under the age of six and 3000 for kids between six and 17. Thanks to the American Rescue Plan the vast majority of families will receive 3000 per child ages 6-17 years old and 3600 per child under 6 as a result of the increased. The update to the online portal allows families to quickly and easily update their mailing.

Single or married and filing separately. June 28 2021. This means that instead of receiving monthly payments of say.

Making a new claim for Child Tax Credit. You can also use the tool to unenroll from receiving the monthly. The IRS on Wednesday added a new feature to its Child Tax Credit Update Portal to allow individuals to update their bank account information in order to receive monthly advance.

The amount you can get depends on how many children youve got and whether youre. To reduce the chances of an overpayment you will be able to update the IRS later this summer about changes to your dependents marital status and income through the child. Half of the money will come as six monthly payments and half as a 2021 tax credit.

When I signed in to the Child Tax Credit Update Portal at irsgov it only says that its for updating direct deposit information but since Im ineligible. The Child Tax Credit Update Portal allows you to verify your eligibility for the payments. The IRS has promised to launch two online tools by July 1.

The Child Tax Credit Update Portal has been updated to allow families to update their direct deposit information or to unenroll from receiving advance payments for the child. Already claiming Child Tax Credit. Families who are expecting a baby to arrive this year can also claim the child tax credit cash.

The IRS will pay 3600 per child to parents of young children up to age five. One portal will allow. The credit is divided by 12 with one-twelfth deposited.

Heres How The Child Tax Credit Could Affect Your 2022 Taxes.

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back

Childctc The Child Tax Credit The White House

Child Tax Credit 2022 Irs Warns Some Families May Have Received Incorrect Letter Fox Business

The Advance Child Tax Credit What Lies Ahead

White House Launches New Portal So Families Can Claim Child Tax Credit Stimulus Check

Child Tax Credit 2022 750 Direct Payments Being Sent To Thousands In Just Weeks Find Out Exact Date The Us Sun

Who S Not Eligible For Child Tax Credit Payments It May Explain Why You Re Not Getting Them Kiplinger

How To Claim The Child Tax Credit For A Baby Born In 2021 Goodrx

Child Tax Credit Update Portal Internal Revenue Service

Stimulus Update Parents With Newborn Babies Will Get 3 600 In Child Tax Credit Payment The Us Sun

A 5 000 Baby Bonus Here S What Tax Credits Await Parents With Kids Born This Year

Advance Child Tax Credit Eligibility 2021 The Military Wallet

New 3 600 Child Tax Credit Portal How To Unenroll From Child Tax Credit 2021 Youtube

Child Tax Credit Payments Taxact

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back

![]()

Child Tax Credit Update Irs Launches Two Online Portals

About The Child Tax Credit Momsrising

How Does The 2021 Child Tax Credit Affect Your Income Taxes Goodrx